Every car owner is required by law to have no-fault insurance in Michigan. No-fault insurance covers medical expenses, damage to other people’s property, loss of wages, and replacement services. It is called no-fault because these benefits are not tied to any specific person who caused the accident. They are paid out no matter who was at fault. There are some limitations to this coverage. For example, this type of benefit does not pay for repairs to the vehicle that caused the accident.

There are three parts to this insurance: personal injury protection (PIP), property protection (PPI), and residual liability insurance (bodily injury and property damage). PIP covers all medical expenses and 85 percent of income that would have been earned if no injury occurred, for up to three years. PPI can pay up to $1 million for damage done by person’s car to other people’s property in Michigan. The coverage also encompasses damage done to properly parked cars that are hit by the covered car. No other damage to the car is covered. Residual liability insurance is protection against being sued as a result of an auto accident.

This does not cover every possibility of being sued but does offer some protection. One interesting factor regarding this coverage is that one policy covers every member of the same family living in the same household. The family member can be a passenger in another car or even a pedestrian and be covered.

Personal Injury Protection Claims

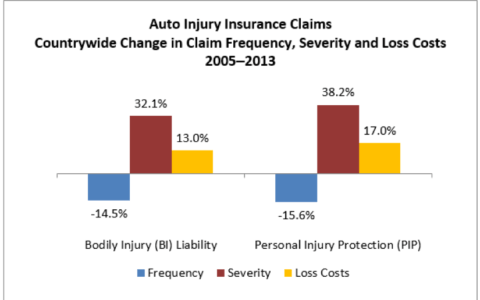

The Insurance Research Council conducted their annual survey in 2015 called Trends in Injury Claims and found that PIP claims over a period of time from 2005 to 2013 declined 15.6 percent nationwide. During this same period of time though the average payment per paid PIP claim rose from approx. $26,000 to $45,000 in Michigan. This signifies an almost 73 percent rise for Michigan.

Table from Insurance Research Council Trends in Injury Claims, 2015 Edition

Catastrophic Claims

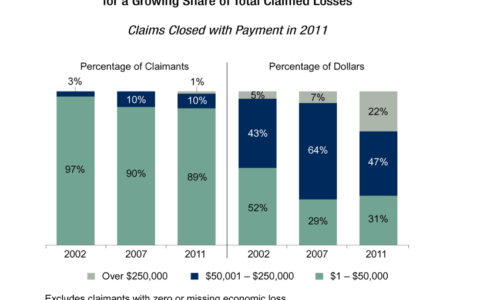

In 2011, the Insurance Research Council reviewed catastrophic claims from 2002 to 2011 in Michigan and found that claimed losses rose on average 13% per year during that time frame, which equaled a 192 percent increase. So the 1 percent of claims over $250,000 is equal to 22 percent of the total dollars claimed.

How Can Costs Be Managed?

Northwood is a Durable Medical Equipment Benefits Manager (DBM) and Pharmacy Benefits Manager (PBM) that manages a national network of contracted providers. Northwood can provide their expertise on efficient methods for controlling costs associated with auto-related medical expenses. The contracted providers are compliant with the no-fault insurance rules and regulations. Northwood has over 20 years of experience in the durable medical equipment, prosthetics and orthotics, and medical supplies (DMEPOS) industry which is invaluable to all insurance carriers.

Do not hesitate to contact us to discuss how we can save you money related to auto injury medical expenses.

Leave a reply →